5 Surprising Truths About the PAN-Aadhaar Link You Need to Know

The deadline to link your Permanent Account Number (PAN) with your Aadhaar card has been a source of widespread discussion and anxiety. While most people are aware of the requirement and the penalty for missing the cutoff, the conversation often stops there, leaving crucial details in the shadows.

Beyond the headlines, the PAN-Aadhaar linking mandate is more nuanced than it appears. There are specific exemptions that many overlook, and the consequences of non-compliance extend far beyond a simple fine. Understanding these hidden truths is essential for navigating the requirements correctly and avoiding unnecessary financial trouble.

This article cuts through the noise to bring you five surprising and impactful facts about the PAN-Aadhaar link. These are the details you need to know to understand what’s truly at stake and what your next steps should be.

1. The “Mandatory” PAN-Aadhaar Link Isn’t Actually for Everyone

While the rule to link PAN with Aadhaar is broad, the Income Tax Act, 1961, provides clear exemptions for specific categories of individuals. It’s crucial to know if you fall into one of these groups before taking any action.

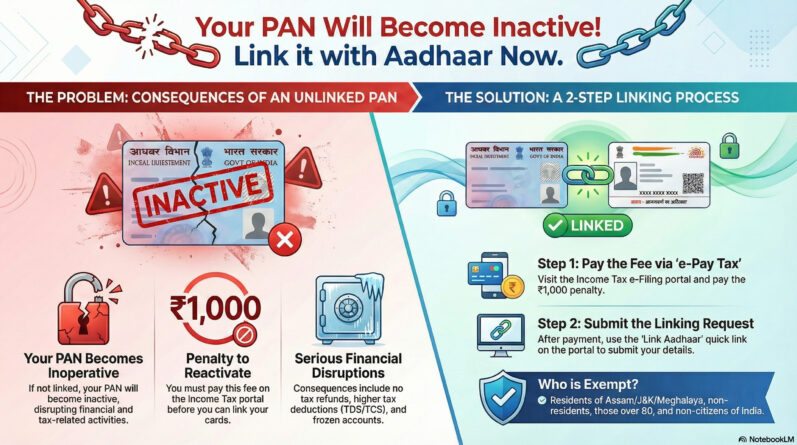

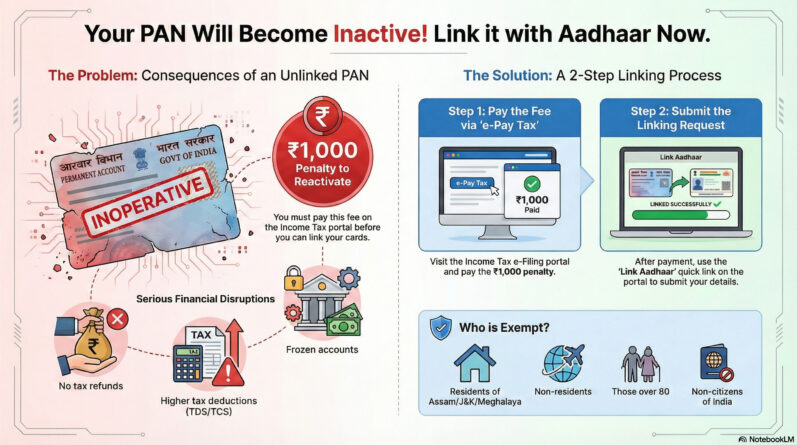

The Aadhaar-PAN linkage requirement does not apply to individuals who are:

- Residing in the states of Assam, Jammu and Kashmir, and Meghalaya

- Non-residents as per the Income Tax Act, 1961

- Aged 80 years or more during the previous financial year

- Not citizens of India

Knowing these exemptions can save you from unnecessary panic and effort if the mandate does not apply to your situation.

2. An “Inoperative” PAN Means More Than Just a ₹1,000 Fine

The biggest consequence of failing to link your PAN and Aadhaar is not the ₹1,000 penalty. It is the fact that your PAN becomes inoperative, leading to serious financial restrictions.

If your PAN is inoperative, you may face the following issues:

- No income tax refunds will be issued

- No interest will be paid on pending tax refunds

- Higher Tax Deducted at Source (TDS)

- Higher Tax Collected at Source (TCS)

In simple terms, the penalty is a one-time cost, but an inoperative PAN can block refunds worth thousands of rupees while increasing your tax burden. This makes timely linking extremely important.

3. Late Fees Have Earned the Government Over ₹600 Crore

The number of taxpayers who missed the PAN-Aadhaar linking deadline is massive, and the penalty collection proves it.

The Indian government has collected over ₹600 crore in penalties from individuals who failed to link their PAN with Aadhaar within the prescribed timelines.

This figure highlights the widespread confusion and challenges faced by taxpayers, turning a compliance requirement into a major source of penalty revenue.

4. Reactivating an Inoperative PAN Is Not Instant

If your PAN has become inoperative, reactivating it is a multi-step process that takes time. Paying the penalty alone does not immediately restore your PAN.

Steps to reactivate your PAN:

- Pay the Penalty: Pay ₹1,000 through the e-Pay Tax portal.

- Wait for Confirmation: The payment verification may take 4–5 days.

- Submit PAN-Aadhaar Linking Request: Only after payment confirmation.

- Final Reactivation: PAN becomes operative within 7 to 30 days after UIDAI validation.

The process requires patience, so early action is always the better option.

5. Deadline Extensions Exist, But Only for a Very Limited Group

Many people assume that deadline extensions apply to everyone. This is not true.

The general deadline for PAN-Aadhaar linking was June 30, 2023. PANs not linked by this date are already inoperative.

However, limited extensions have been provided in the past for individuals who were allotted PANs using an Aadhaar enrolment ID during the initial implementation phase.

Important: This extension does not apply to most taxpayers. If your PAN is already inoperative, the only solution is to pay the penalty and complete the linking process.

Conclusion: What Should You Do Next?

The PAN-Aadhaar mandate involves more than just meeting a deadline. Exemptions, financial consequences, penalties, and reactivation timelines all play a critical role.

Before assuming you are compliant or assuming it is too late, the smartest move is to check your PAN-Aadhaar linking status on the official income tax portal.