PAN–Aadhaar Linking Explained: Who Must Link, Deadlines, Penalties & Real Impact (2025 Guide)

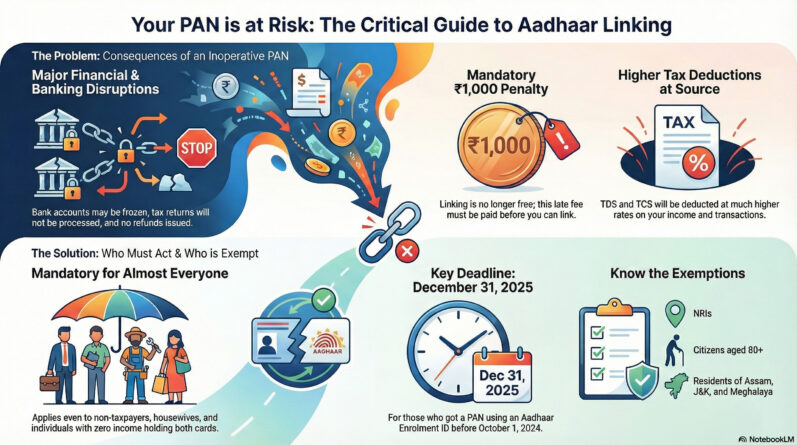

The PAN–Aadhaar linking rule is often misunderstood as something that only affects taxpayers.

In reality, this requirement applies to almost everyone who holds both PAN and Aadhaar, even if they have never filed an income tax return.

This blog explains the PAN–Aadhaar linking rules, deadlines, penalties, exemptions, and real financial impact in a clear and simple way.

1. PAN–Aadhaar Linking Is Mandatory for Everyone

As per Section 139AA of the Income Tax Act, every individual who was allotted a PAN on or before 1 July 2017 and is eligible for Aadhaar must link the two.

This rule applies even if you are:

- A housewife

- A non-taxpayer

- Someone with zero income

- A person who has never filed an ITR

If you hold both PAN and Aadhaar, linking is compulsory unless you fall under an exempted category.

2. Important PAN–Aadhaar Linking Deadlines

While earlier deadlines have passed, there is an important upcoming date that many people must remember.

31 December 2025 is the last date for individuals who obtained their PAN using an Aadhaar Enrolment ID before 1 October 2024.

If PAN is not linked by this date, it will become inoperative from 1 January 2026.

3. What Happens When PAN Becomes Inoperative

An inoperative PAN does not get cancelled, but it becomes unusable for most financial and tax-related activities.

Tax-related impact:

- Income Tax Return will not be processed

- No tax refund will be issued

- No interest on pending refunds

- TDS and TCS will be deducted at higher rates

Banking and investment impact:

- Bank accounts may be frozen or restricted

- Demat and trading accounts may be suspended

- Problems in opening new bank accounts or investments

4. Penalty for Late PAN–Aadhaar Linking

Linking PAN with Aadhaar is no longer free.

- A mandatory penalty of ₹1,000 must be paid

- Without payment, linking request cannot be submitted

- The government has already collected over ₹600 crore in penalties

5. How to Link PAN with Aadhaar Online

You can link PAN and Aadhaar through the Income Tax e-filing portal using two methods:

- Login to the portal and link Aadhaar from your profile

- Use the “Link Aadhaar” option without logging in

Check PAN–Aadhaar link status via SMS:

Send the following message:

UIDPAN <12-digit Aadhaar> <10-digit PAN>

Send SMS to 567678 or 56161

6. What to Do If PAN–Aadhaar Linking Fails

Linking may fail due to mismatch in:

- Name

- Date of birth

- Gender

In such cases, first correct the details in PAN or Aadhaar records and then retry the linking process.

7. Who Is Exempt from PAN–Aadhaar Linking

The following individuals are exempt from linking:

- Residents of Assam, Jammu and Kashmir, and Meghalaya

- Non-residents (NRIs) under the Income Tax Act

- Individuals aged 80 years or above

- Individuals who are not citizens of India

8. Simple Example to Understand PAN–Aadhaar Linking

Think of your PAN as a utility meter. If it is not registered properly, the meter is not removed, but services are restricted.

You are charged at the highest rate and do not receive any benefits until registration is completed and penalty is paid.

Final Thoughts

PAN–Aadhaar linking is no longer just a tax formality. It directly affects banking, investments, refunds, and financial freedom.

If you have not linked your PAN yet, check your status today and complete the process well before 31 December 2025 to avoid future trouble.